The Medicare Secondary Payer Manual provides guidance on MSP policies‚ ensuring compliance and proper billing practices for providers and insurers․ It outlines coordination of benefits and beneficiary rights‚ serving as a comprehensive reference for understanding Medicare’s role as a secondary payer․

Overview of the Medicare Secondary Payer (MSP) Program

The Medicare Secondary Payer (MSP) Program ensures Medicare is not the primary payer when other insurance coverage exists․ It applies to group health plans‚ liability insurance‚ workers’ compensation‚ and no-fault insurance․ The program prevents Medicare from overpaying by requiring primary payers to cover claims first․ Providers and insurers must comply with MSP rules to avoid financial penalties․ The manual guides accurate billing‚ beneficiary protections‚ and coordination of benefits‚ ensuring proper payment order and compliance with federal regulations․

Purpose and Scope of the MSP Manual

The MSP Manual serves as a guide for understanding Medicare’s role as a secondary payer‚ ensuring proper payment and compliance․ It provides tools like the Search Strategy Builder for research and outlines mandatory reporting requirements․ The manual addresses beneficiary rights‚ liability insurance‚ and workers’ compensation‚ offering clarity on primary payer responsibilities․ It helps reduce Medicare overpayments by ensuring accurate claims submission and adherence to federal regulations‚ benefiting providers‚ insurers‚ and beneficiaries alike․

Key Concepts in the Medicare Secondary Payer Manual

The manual defines Medicare Secondary Payer (MSP) principles‚ distinguishing primary and secondary payer roles‚ and outlines beneficiary protections‚ ensuring accurate claims submission and compliance with MSP policies․

Definition of Medicare Secondary Payer

Medicare Secondary Payer (MSP) refers to situations where Medicare does not pay first for medical services․ It applies when other insurance‚ such as group health plans‚ liability‚ or workers’ compensation‚ is primary․ MSP ensures proper payment responsibility‚ reducing Medicare costs by shifting liability to the appropriate payer․ This concept is central to the manual‚ guiding providers and insurers on when Medicare acts as a secondary payer for eligible beneficiaries․

Primary vs․ Secondary Payer: Understanding the Distinction

The primary payer is the insurance responsible for paying first for medical services‚ while the secondary payer covers remaining costs․ Medicare typically acts as secondary if other insurance‚ such as group health plans‚ liability‚ or workers’ compensation‚ is available․ Understanding this distinction ensures accurate billing and compliance with MSP regulations‚ preventing payment errors and reducing financial liability for providers and insurers․

Types of Insurance That May Be Primary to Medicare

Insurance that may be primary to Medicare includes group health plans‚ liability insurance‚ workers’ compensation‚ and no-fault insurance․ These payers assume first responsibility for covering medical costs‚ with Medicare stepping in as secondary․ Understanding these primary payers is essential for accurate billing and compliance‚ ensuring Medicare only pays its share after primary insurers have contributed․

How Medicare Secondary Payer Works

Medicare Secondary Payer ensures Medicare isn’t the first payer when other insurance exists․ It uses tools like the MSP Questionnaire to determine primary responsibility‚ coordinating benefits to prevent Medicare from paying amounts due from other insurers․

The Role of the Medicare Secondary Payer Questionnaire

The Medicare Secondary Payer Questionnaire collects patient data to determine if Medicare should be the primary or secondary payer․ It gathers details about other insurance coverage‚ such as employer plans or liability insurance‚ to ensure accurate billing and compliance with MSP rules․ By identifying primary payer responsibility‚ it helps prevent Medicare from paying amounts due from other insurers‚ ensuring proper coordination of benefits and adherence to program guidelines․

Determining Primary Payer Responsibility

Determining primary payer responsibility involves identifying the insurance provider obligated to pay first for a beneficiary’s medical services․ Medicare Secondary Payer rules prioritize other payers‚ such as employer group health plans or liability insurance‚ over Medicare․ Providers and insurers use tools like the Medicare Secondary Payer Questionnaire and claims data to assess coverage and ensure accurate billing․ This process prevents Medicare from paying amounts due from other primary payers‚ ensuring compliance with MSP guidelines and proper claims processing․

Coordination of Benefits with Other Insurance

Coordination of benefits ensures the correct insurance pays first‚ preventing improper Medicare payments․ Tools like the MSP Questionnaire aid in determining primary payer status․ This process is crucial for compliance‚ especially with employer plans‚ liability insurance‚ and workers’ compensation․ Accurate claims submission and verification ensure Medicare only pays its secondary share‚ maintaining proper financial responsibility and cost management․ This ensures that Medicare does not overpay and that primary payers fulfill their obligations‚ maintaining efficient healthcare financing․

Compliance Requirements for the MSP Program

Compliance with the MSP Program is essential for accurate payments and avoiding penalties‚ applying to providers‚ insurers․ It involves reporting requirements‚ proper billing‚ and verifying primary payer status to ensure Medicare only pays its secondary share‚ preventing overpayments and ensuring financial integrity․

Reporting Requirements for Providers and Insurers

Providers and insurers must submit accurate claims and notify Medicare of primary payer status to ensure proper payment․ Timely reporting prevents overpayments and penalties‚ maintaining compliance with MSP regulations․ The Medicare Secondary Payer Questionnaire aids in gathering necessary beneficiary details․ Accurate and timely reporting ensures financial integrity and avoids legal consequences‚ fostering a smooth coordination of benefits process․

Consequences of Non-Compliance with MSP Regulations

Non-compliance with MSP regulations can result in penalties‚ fines‚ and legal actions against providers and insurers․ Overpayments may require repayment‚ and failure to report accurately can lead to financial and reputational risks․ Compliance ensures proper coordination of benefits‚ avoiding disputes and financial losses․ Accurate billing and timely reporting are essential to prevent these consequences and maintain adherence to MSP guidelines․

Mandatory Reporting and Liability Insurance

Mandatory Reporting and Liability Insurance explores how MSP interacts with liability insurance and workers’ compensation‚ ensuring proper reporting to avoid overpayments and compliance issues effectively․

Liability Insurance and Workers’ Compensation

Liability insurance and workers’ compensation plans often assume primary payment responsibility over Medicare․ The MSP Manual details how these insurance types interact with Medicare‚ ensuring proper billing and reporting․ It outlines scenarios where Medicare acts as a secondary payer‚ such as in settlements or judgments‚ and emphasizes the importance of accurate claims submission to avoid overpayments․ Compliance with MSP regulations is crucial to prevent penalties and ensure correct reimbursement processes are followed․

Self-Insurance and No-Fault Insurance Under MSP

Self-insurance and no-fault insurance plans often serve as primary payers to Medicare under the MSP program․ The manual clarifies that self-insured entities‚ such as employers‚ and no-fault insurers‚ like automobile insurers‚ must assume primary payment responsibility for beneficiary claims․ It outlines reporting requirements for these entities to ensure compliance with MSP regulations‚ preventing improper Medicare payments and avoiding penalties for non-compliance․ Accurate claims submission and proper documentation are emphasized to maintain program integrity․

Medicare Secondary Payer and Beneficiary Rights

The MSP program ensures beneficiaries receive proper coverage by protecting their rights‚ including access to necessary medical services and appeals processes for disputed claims․

Beneficiary Protections Under the MSP Program

The MSP program ensures beneficiaries receive necessary medical services without improper financial burden․ It prevents Medicare from being wrongly billed as the primary payer when another entity is responsible․ This protection maintains seamless healthcare access and upholds beneficiaries’ legal rights‚ ensuring they are not unfairly held liable for costs that should be covered by primary payers․

- Prevents gaps in coverage due to payer disputes․

- Safeguards against improper billing practices․

- Ensures beneficiaries are not financially penalized․

Appeals Process for Medicare Secondary Payer Decisions

The MSP program includes a structured appeals process for beneficiaries and providers to dispute Medicare’s secondary payer decisions․ This process ensures fair resolution of payment disputes and protects stakeholders’ rights․ Beneficiaries can request a redetermination if they disagree with Medicare’s decision‚ followed by reconsideration and further appeals if needed․ Clear guidelines and timelines are provided to facilitate efficient resolution of disputes․

- Ensures transparency in dispute resolution․

- Provides multiple levels of appeal for fairness․

- Protects stakeholders’ rights and interests․

Provider Responsibilities and Billing Practices

Providers must ensure accurate billing and verify Medicare’s primary or secondary payer status before submitting claims․ Compliance with MSP regulations is crucial to avoid payment issues․

- Verify primary payer status․

- Submit accurate claims․

- Adhere to MSP guidelines․

Accurate Billing and Claims Submission

Accurate billing ensures Medicare is billed correctly as secondary payer when applicable․ Providers must verify primary payer status using the MSP Questionnaire and submit claims with proper documentation․ Timely submission prevents denied claims and delays․ Compliance with MSP regulations is essential‚ requiring correct coding and modifier usage․ Proper billing practices prevent payment issues and ensure Medicare isn’t overpaid․ Providers must follow guidelines to avoid errors and ensure seamless reimbursement processes․

Verification of Primary Payer Status

Verification of primary payer status is critical to ensure Medicare is billed correctly as secondary payer․ Providers must use the Medicare Secondary Payer Questionnaire to determine primary payer responsibility․ Accurate documentation and timely submission of claims are essential to avoid denied claims or payment delays․ Proper verification ensures compliance with MSP regulations and prevents overpayments to Medicare․ This step is vital for maintaining accurate billing and reimbursement processes․

Recent Updates and Changes to the MSP Manual

Recent updates to the MSP Manual reflect legislative changes and emerging enforcement trends‚ ensuring alignment with current healthcare policies and regulations․

Impact of Legislative Changes on MSP Policies

Legislative changes have significantly influenced MSP policies‚ ensuring compliance with updated healthcare regulations․ These changes often clarify primary payer responsibilities and streamline reporting requirements․ They also address emerging issues like data analytics in claims screening‚ ensuring Medicare’s role as a secondary payer is maintained․ Stakeholders must stay informed to adapt to these updates‚ which are crucial for accurate billing and avoiding penalties․ CMS regularly releases updates to reflect these changes‚ ensuring alignment with current healthcare policies․

Emerging Trends in Medicare Secondary Payer Enforcement

Emerging trends in MSP enforcement highlight the use of advanced data analytics and AI to identify non-compliance․ CMS is increasingly leveraging technology to screen claims for primary payer signs․ Automation tools and digital health platforms are streamlining reporting processes․ These trends emphasize proactive compliance and faster dispute resolution․ Stakeholders must adapt to these innovations to avoid penalties and ensure accurate coordination of benefits․ Enforcement strategies continue to evolve‚ focusing on efficiency and accountability in MSP-related matters․

Tools and Resources for MSP Compliance

The Medicare Secondary Payer Manual offers tools like the Search Strategy Builder and CMS resources to streamline MSP compliance processes‚ ensuring accurate reporting and adherence to regulations․

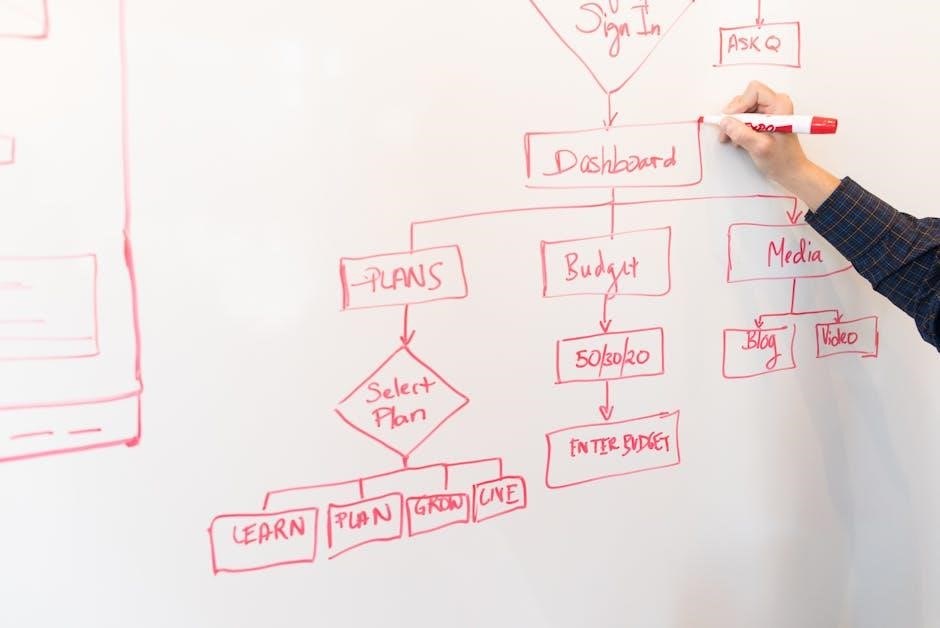

Utilizing the Search Strategy Builder for MSP Research

The Search Strategy Builder is a valuable tool for constructing effective search strings using Boolean logic․ It allows users to input keywords and synonyms‚ generating a tailored query for databases․ This resource enhances MSP research efficiency by streamlining the identification of relevant policies and guidelines․ By leveraging truncation and wildcards‚ it ensures comprehensive results‚ making it an essential aid for compliance and accurate Medicare Secondary Payer program analysis․

Medicare Secondary Payer Questionnaire: Best Practices

Best practices for using the Medicare Secondary Payer Questionnaire involve timely distribution‚ clear instructions‚ and thorough documentation․ Ensure beneficiaries understand the purpose and provide accurate‚ complete information․ Verify responses against claims data and follow up on incomplete or unclear answers․ Maintain detailed records and update as needed․ This ensures compliance‚ reduces errors‚ and streamlines the determination of primary vs․ secondary payer status‚ aligning with MSP program requirements and beneficiary protections․

Case Studies and Practical Examples

Case studies provide real-world insights into MSP scenarios‚ illustrating how Medicare interacts with primary payers․ Practical examples clarify MSP policies‚ ensuring accurate application and compliance in various situations․

Real-World Applications of the MSP Manual

The MSP Manual is applied in scenarios involving liability insurance‚ workers’ compensation‚ and employer group health plans․ It guides providers in determining primary vs․ secondary payer responsibilities‚ ensuring accurate billing and compliance․ Real-world examples include resolving payment disputes‚ coordinating benefits‚ and addressing beneficiary appeals․ Practical applications also involve updating policies based on legislative changes‚ ensuring providers and insurers adhere to MSP regulations effectively․ These examples highlight the manual’s critical role in navigating complex payment scenarios․

Lessons Learned from MSP-Related Disputes

Disputes often stem from miscommunication and misapplication of MSP policies․ Clear understanding of primary vs․ secondary payer roles and accurate billing practices are crucial․ Proper documentation and training on MSP guidelines help prevent errors․ Non-compliance can lead to penalties‚ emphasizing the need for strict adherence to regulations․ These lessons highlight the importance of precise coordination of benefits and maintaining open communication between providers and insurers to avoid conflicts and ensure fair reimbursement processes effectively․

The Medicare Secondary Payer Manual is a vital resource for ensuring compliance‚ proper billing‚ and coordination of benefits‚ helping to avoid legal disputes and financial penalties effectively․

Future Implications of the Medicare Secondary Payer Program

The Medicare Secondary Payer Program will likely see increased enforcement and regulatory updates‚ driven by legislative changes and technological advancements; Enhanced data analytics and monitoring tools will improve detection of non-compliance‚ ensuring proper coordination of benefits․ Stakeholders must stay informed about evolving policies to maintain adherence and avoid penalties‚ as the program continues to adapt to healthcare and legal landscapes․